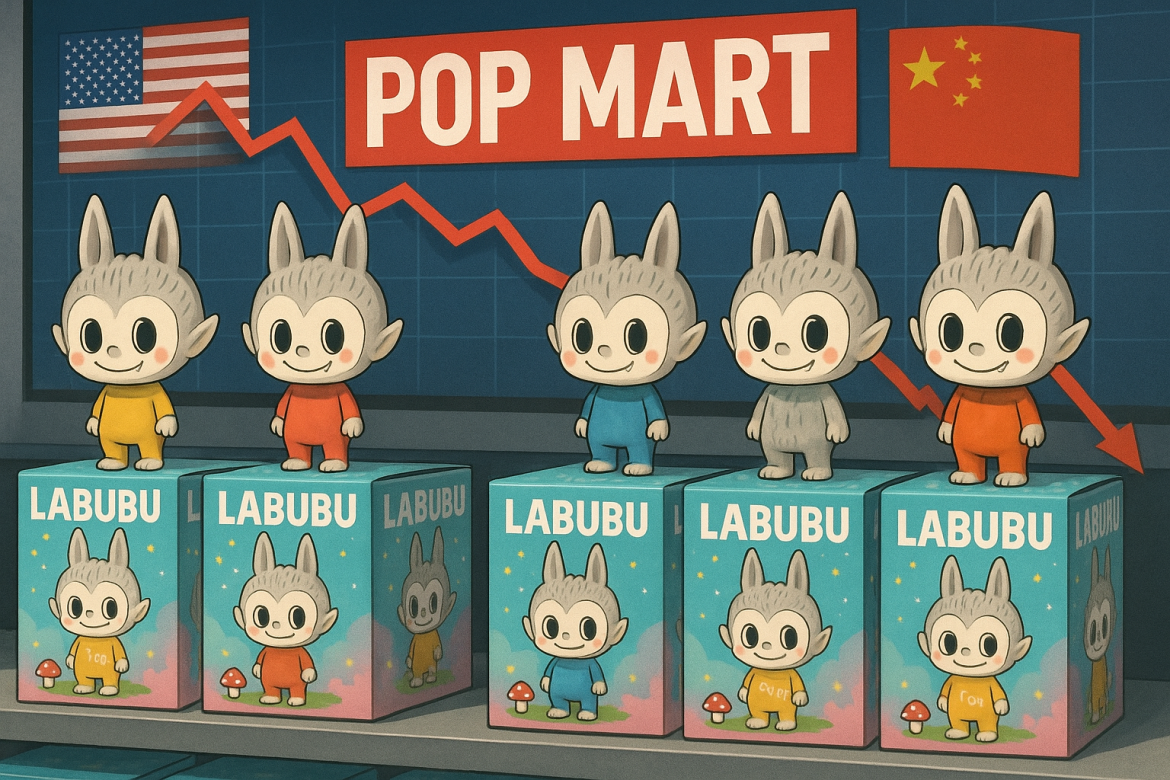

Shares of Chinese toymaker Pop Mart fell sharply on Thursday, tumbling 9% in their worst single-day drop since April and extending a monthslong decline that has erased much of the company’s summer gains.

The stock has now fallen around 30% since late August, even as it remains up 159% for the year.

The selloff follows concerns that demand for Pop Mart’s best-known collectibles—particularly its Labubu dolls—may be losing momentum after months of frenzied buying and record resale prices.

Revenue triples but market cools

Pop Mart, famous for its Labubu dolls, elf-like monster figurines sold in blind-box packaging, reported on Tuesday that third-quarter revenue more than tripled year over year, driven primarily by a surge in US sales.

According to the company, American demand rose between 1,265% and 1,270% over the same period in 2024.

Despite the robust financial results, investor reaction has been cautious.

The company’s stock, which peaked in August amid a collectibles boom, has since been weighed down by signs of weakening enthusiasm in both domestic and international markets.

Data from the Chinese resale platform Qiandao shows a notable shift in pricing trends for Labubu dolls.

Items that once commanded high resale premiums are now trading close to, or even below, their original retail prices.

For instance, the Labubu “Luck” edition, released in April, initially soared to over 500 yuan ($70) on secondary markets but has since dropped to about 108 yuan ($15).

Analysts divided over decline

Market observers are split over whether the recent correction marks a broader slowdown in Pop Mart’s growth or a short-term adjustment following a period of intense speculation.

Some analysts argue the fall in resale prices could signal waning excitement among Pop Mart’s younger customer base, which has been driving much of the brand’s success in China and abroad.

They suggest that the collectibles’ popularity may have peaked during the summer surge.

Others believe the pricing decline is a byproduct of Pop Mart’s efforts to stabilize the market by ramping up production and reducing opportunities for scalpers.

The company reported a tenfold increase in plush toy output this year, now manufacturing approximately 30 million units per month.

In a September note, Morgan Stanley analysts said that “prices in the second-hand market do not effectively reflect the true supply and demand situation,” noting Pop Mart’s proactive steps to manage inventory and discourage reseller-driven volatility.

Broader growth opportunities remain

While the Labubu dolls remain Pop Mart’s flagship franchise, analysts see potential in the company’s emerging characters, such as Twinkle Twinkle, and its ongoing global expansion initiatives.

Celebrity endorsements, from singer Rihanna to former soccer star David Beckham, have helped fuel international awareness of the brand.

Yet maintaining momentum will depend on whether Pop Mart can diversify beyond Labubu’s initial success and sustain its appeal among nontraditional toy buyers.

Despite recent turbulence, Pop Mart remains one of China’s most prominent pop culture exports.

The coming quarters will test whether its rapid expansion and product diversification can offset cooling resale markets and shifting consumer sentiment.

The post Pop Mart shares slide 9% as enthusiasm for Labubu dolls shows signs of cooling appeared first on Invezz